EBITDA Full Form: Explained in Detail

In the world of finance and business, understanding key financial metrics is crucial. EBITDA is one such metric that plays a significant role in assessing a company’s financial performance. In this article, we will delve into the full form of EBITDA, its components, calculation, importance, limitations, and its applications in various financial contexts.

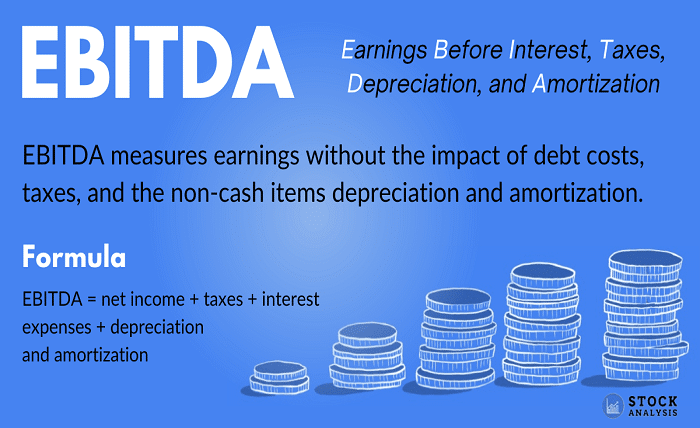

What is EBITDA?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It is a financial indicator used to evaluate a company’s operating performance and profitability before accounting for non-operating expenses and non-cash items. EBITDA provides a clear picture of a company’s core operations by excluding certain expenses and financial factors.

Components of EBITDA

The components of EBITDA are as follows:

- Earnings: The total revenue generated by a company from its core operations.

- Interest: The interest expense incurred by the company on its outstanding debt.

- Taxes: The income taxes paid by the company to the government.

- Depreciation: The systematic allocation of the cost of tangible assets over their useful life.

- Amortization: The systematic allocation of the cost of intangible assets over their useful life.

Calculation of EBITDA

EBITDA can be calculated using the following formula:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

Importance of EBITDA

EBITDA holds significance in various aspects of financial analysis and decision-making. Here are some key reasons why EBITDA is important:

- Performance Evaluation: EBITDA provides a clear view of a company’s operating performance by excluding non-operating factors.

- Comparability: EBITDA allows for better comparison between companies within the same industry, as it eliminates the impact of different capital structures and tax rates.

- Cash Flow Assessment: EBITDA serves as a proxy for a company’s cash flow from operations, as it excludes non-cash expenses.

- Investment Analysis: EBITDA is utilized by investors to assess the profitability and growth potential of a company.

- Debt Analysis: Lenders often consider EBITDA when evaluating a company‘s ability to service its debt obligations.

Limitations of EBITDA

While EBITDA is a widely used financial metric, it does have its limitations. It is important to be aware of these limitations when interpreting EBITDA figures:

- Exclusion of Key Expenses: EBITDA does not consider interest, taxes, depreciation, and amortization, which are crucial elements in financial analysis.

- Varying Capital Structures: EBITDA does not account for differences in capital structures among companies, potentially leading to misleading comparisons.

- Manipulation Possibilities: EBITDA can be manipulated by companies through various accounting practices, making it important to consider other financial metrics as well.

EBITDA vs. Net Income

EBITDA and net income are two distinct measures of a company’s financial performance. While net income represents the total earnings of a company after accounting for all expenses, EBITDA focuses solely on the operating performance by excluding non-operating factors. Net income is calculated using the following formula:

Net Income = Revenue - Expenses (including interest, taxes, depreciation, and amortization)

EBITDA in Financial Analysis

In financial analysis, EBITDA serves as a valuable metric for assessing a company’s profitability and efficiency. It enables analysts to compare the performance of companies within the same industry, as it provides a clearer view of their operating performance. EBITDA is often used in conjunction with other financial ratios and indicators to gain a comprehensive understanding of a company’s financial health.

EBITDA in Business Valuation

When valuing a business, EBITDA is commonly used as a key financial metric. It helps determine the company’s earnings potential by focusing on its core operations. EBITDA multiples are often utilized in business valuation methods such as the EBITDA multiple approach or the market approach, where the company’s value is estimated based on its EBITDA and comparable companies’ multiples.

EBITDA in Corporate Finance

In corporate finance, EBITDA plays a vital role in decision-making processes such as mergers and acquisitions, investment analysis, and capital budgeting. By assessing a company’s EBITDA, financial professionals can evaluate its profitability and determine its ability to generate cash flows from its core operations.

EBITDA in Investment Decisions

Investors and financial analysts often rely on EBITDA when making investment decisions. EBITDA provides insights into a company’s earnings potential and helps investors assess its future prospects. By comparing EBITDA figures across different companies, investors can identify attractive investment opportunities.

EBITDA in Debt Analysis

EBITDA is a crucial metric for lenders when evaluating a company’s creditworthiness and ability to repay debt. Lenders use EBITDA as an indicator of a company’s cash flow generation capabilities, helping them determine the amount of debt the company can comfortably service.

EBITDA Margin

EBITDA margin is a financial ratio that expresses EBITDA as a percentage of a company’s total revenue. It indicates the company’s operating profitability before accounting for interest, taxes, depreciation, and amortization. A higher EBITDA margin implies better operational efficiency and profitability.

EBITDA Adjustments

In some cases, EBITDA may need to be adjusted to provide a more accurate representation of a company’s financial performance. Adjustments can be made to include or exclude certain expenses or non-recurring items that may distort the EBITDA figure. These adjustments help analysts gain a clearer understanding of the company’s underlying financial health.

Conclusion

EBITDA, which stands for Earnings Before Interest, Taxes, Depreciation, and Amortization, is a crucial financial metric used to assess a company’s operating performance and profitability. By excluding certain expenses and non-cash items, EBITDA provides insights into a company’s core operations. It is widely utilized in financial analysis, business valuation, investment decisions, and debt analysis. However, it is essential to understand the limitations of EBITDA and consider other financial indicators for a comprehensive assessment of a company’s financial health.